8 Fundamental Tax Tips: What to Do When Filing Taxes for the First Time

Is this your first time filing taxes? Or maybe you’ve filed for years but still feel you could be doing more to optimize your return? Either way, don’t let your taxes get the best of you. By taking these beginner tax tips, you can make tax season work harder for you, instead of you working hard for it.

Tax Preparation vs. Tax Planning vs. Tax Strategy

When it comes to taxes, there are many different approaches you can take to optimize your return, each with its own benefits — and timeframe.

Tax preparation is the process of completing your tax return, and happens annually in advance of the April 15 deadline. Tax planning is a strategy involving proactive steps to legally reduce your tax liability for the year in the hopes of paying the least allowable amount in tax. Finally, tax strategy is a long-term tax planning method that allows you to align your financial goals with your tax planning strategies to reduce tax liability and generate wealth over time. For a deep dive into the differences between tax preparation vs tax planning vs tax strategy, head over to our blog.

In this article, we will discuss tax preparation tips to help you file your taxes accurately. If you’re interested in tax planning or tax strategy, learn more about our services here and contact us for a consultation.

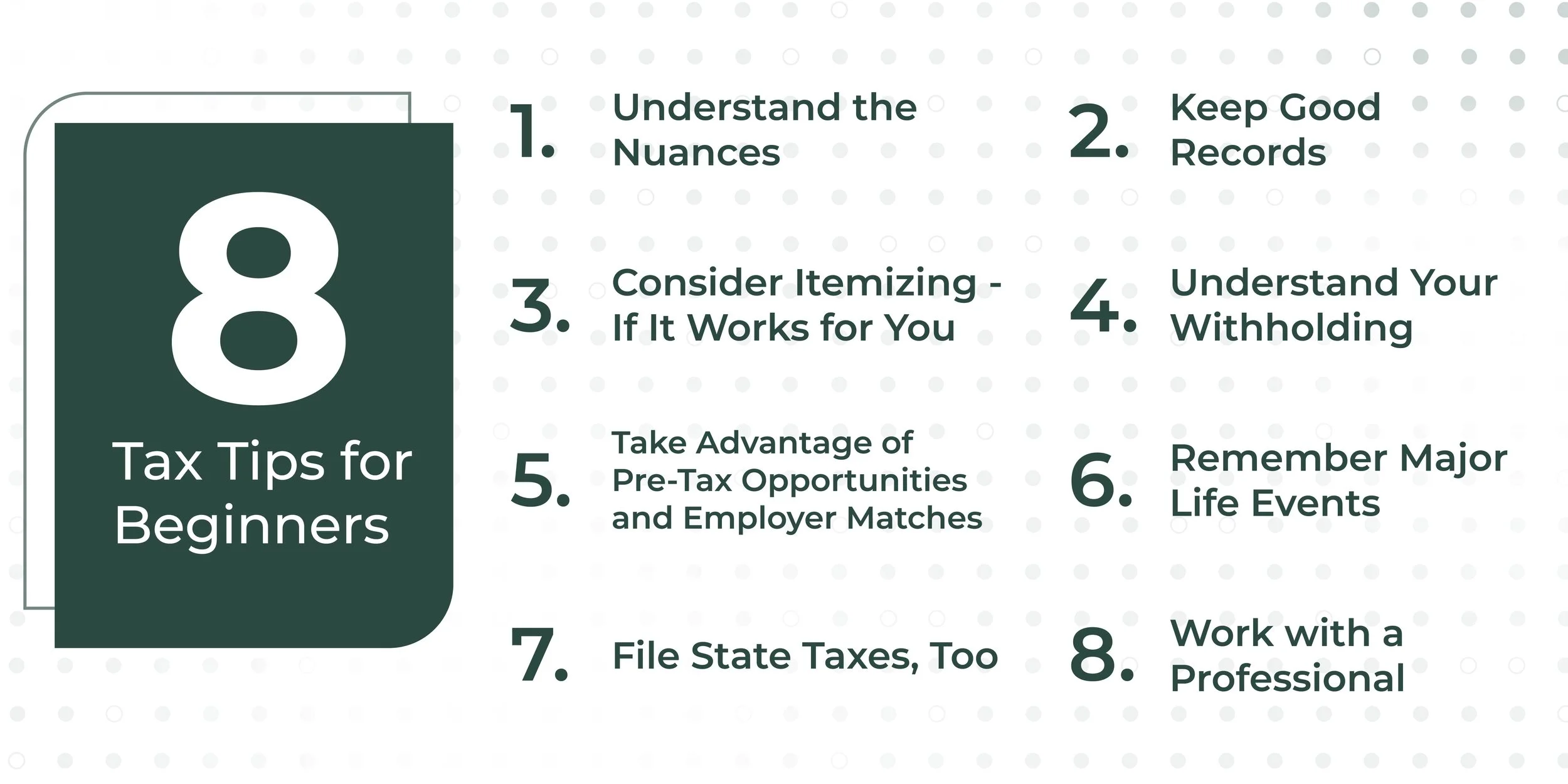

8 Tax Tips for Beginners

Whether or not you’re a true beginner at filing your taxes, there’s always more to learn about tax preparation. We’ve put together the following tips, which can help you optimize your tax return preparation.

1. Understand the Nuances

Before filing, you should understand some nuances about the American tax system.

First, you’ll need to know your tax bracket. Your tax bracket determines how much you pay in taxes, and it depends on your income. In the U.S., we have a progressive tax system, which means people with higher taxable incomes are subject to higher tax rates. Knowing your tax bracket will help you plan for your taxes and prevent a nasty surprise.

Next, you should understand tax credits and deductions. Deductions represent expenses you’ve incurred that reduce your taxable income. Credits represent dollar-for-dollar reductions in your tax bill. As you prepare your taxes, keep an eye out for deductions and credits for which you may be eligible. (If you own a small business, we put together this list of 20 common deductions to consider.

2. Keep Good Records

No matter how you file, you should keep good records of all your tax returns and their associated documentation. This is vital not only for filing but also in case you get audited. Typically, the IRS has three years to decide whether or not to audit a return, so save your documentation for at least that long. There are other unique instances when this time limit should be longer, so consider checking in with a tax professional about your unique circumstances.

3. Consider Itemizing — If It Works for You

Itemizing your expenses is the process of taking all the unique tax deductions for which you qualify. On the other hand, you could take the standard deduction, which is one rate for all the potential deductions for which you may be eligible; this is a common practice, because it makes tax preparation go faster, but may lead to you missing out on deductions.

Depending on your situation, you may want to itemize your expenses, especially if you have deductions over the standard deduction amount. Things like charitable donations, medical bills, and self-employment expenses may make itemizing work better for you.

4. Understand Your Withholding

Your withholding is the amount of federal income tax withheld from your paycheck. It depends on your income, or the information provided by you in your Form W-4. You’ll want to ensure that your withholding is as close as possible to the amount you’ll owe during tax season. Otherwise, you’ll be getting too much or too little taken out, neither of which is the ideal scenario.

If you ended up with a larger tax bill than expected, you may want to increase your withholding. If you got a large refund, but would prefer that money be in your check week-to-week, consider decreasing your withholding.

5. Take Advantage of Pre-Tax Opportunities and Employer Matches

If your workplace offers a 401(K) or other retirement plan, take advantage of it. That is an opportunity to put money away pre-tax. Similarly, if it offers a retirement match, do your best to meet that match — it’s an opportunity to get extra money, directly to your accounts.

Other opportunities to take advantage of include an IRA, a flexible spending account, a health savings account, and more. If these may work for your lifestyle and savings goals, talk to a professional about setting them up and utilizing them.

6. Remember Major Life Events

Getting married? Have a baby? Moving? All these things — and more — can impact your tax situation. Be sure to stay on top of the administrative tasks associated with these major changes, like legally changing your name if you desire, changing your filing status, getting Social Security numbers for new dependents, and more. These administrative tasks may feel like not a big deal, but they can make a difference come tax season.

7. File State Taxes, Too

Don’t forget your state taxes! Most states — including Minnesota — require state taxes to be filed, too. The exact filing deadlines may be different from federal deadlines, so be sure to check your state’s requirements. (In Minnesota, state taxes are due April 15, alongside federal taxes.)

8. Work with a Professional

Feeling overwhelmed? Have a complicated tax situation? Just want peace of mind? There are plenty of reasons to work with a professional on your taxes, even if you feel your taxes are simple. Working with a professional tax professional can reduce stress and errors in your tax filing, plus a professional can help you with tax planning and strategies, too.

Get Ahead of Tax Season with KeyLin

Tax season can feel daunting, whether it’s your first time or your fiftieth time. From withholdings to tax-advantaged accounts, make sure you’re headed in the right direction. By taking these eight fundamental tax tips, you can make tax season go more smoothly.

Looking for a professional? Look no further than KeyLin, your one-stop shop for financial support. From tax preparation and planning to accounting and bookkeeping, we offer everything you may need for your personal and professional finances.