Guide to Bookkeeping for Startups

Did you know that poor financial management is one of the top reasons startups fail? According to a study conducted by The National Federation of Independent Businesses, roughly 82% of startups fail due to cash flow mismanagement. Mastering bookkeeping can help ensure your startup doesn’t become part of that statistic. While it might not be the most exciting part of running a business, having a solid understanding of your financials is essential for growth and sustainability. Whether you’re just getting started or looking to refine your processes, this guide will walk you through the essentials of startup bookkeeping.

Why Bookkeeping is the Key to Financial Success

Before diving into the “how,” let’s take a moment to understand the “why.” Bookkeeping is more than just keeping records of expenses and income—it’s the foundation of smart financial decision-making.

Key Reasons Why Bookkeeping Matters

Keeps your finances organized: Clear records prevent confusion, so you know exactly where your money is going.

Prepares you for tax season: No more scrambling to find receipts or guesswork when tax time comes around.

Helps you understand cash flow and profitability: With regular tracking, you’ll know exactly how your business is performing.

Positions you for future funding or investment opportunities: Clean, organized financial statements will make you more attractive to potential investors.

By getting bookkeeping right from the beginning, startups can avoid costly mistakes and focus on scaling the business.

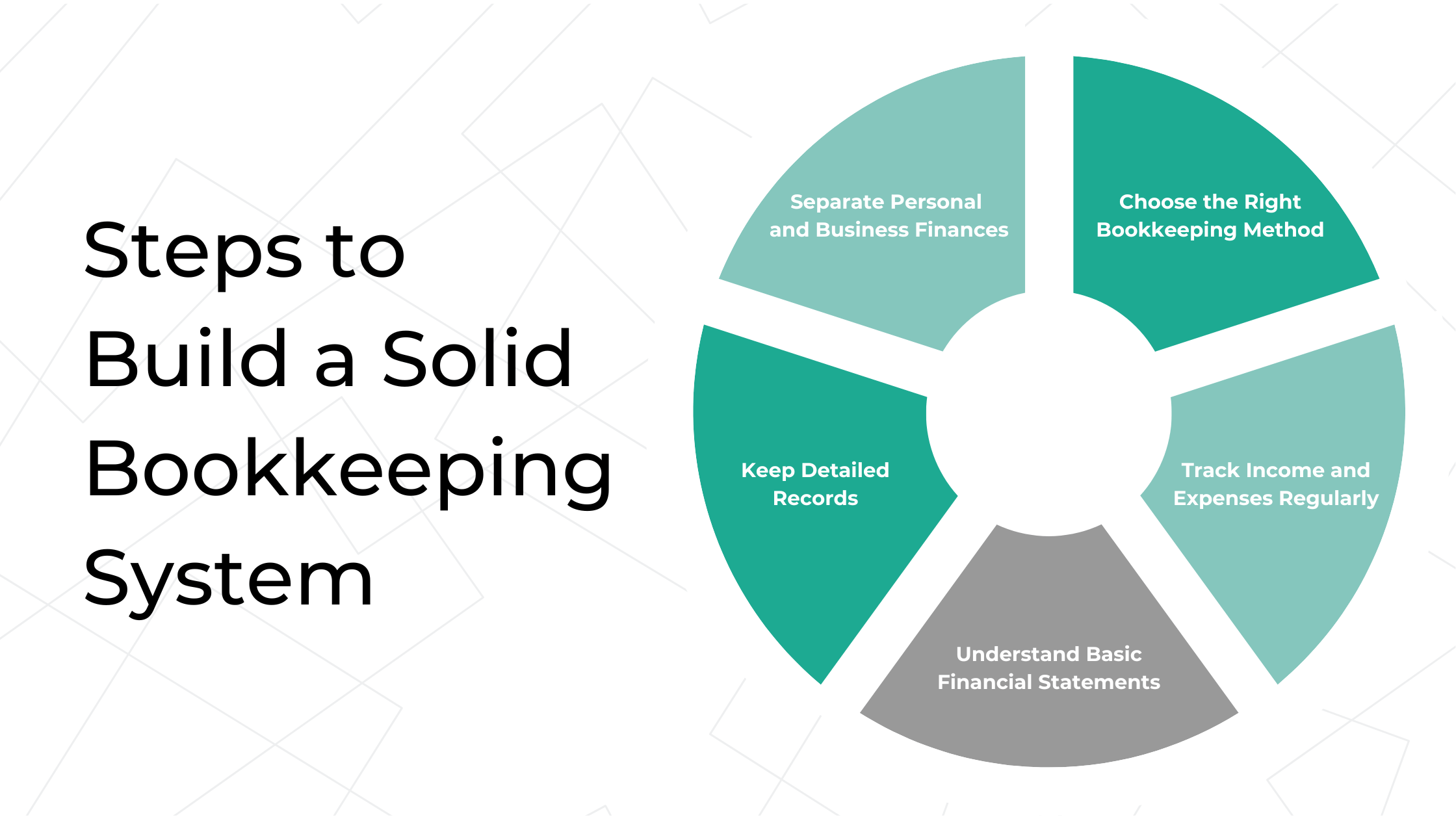

Build a Solid Bookkeeping System: Simple Steps for Startups

When it comes to bookkeeping, there are a few foundational elements every startup needs to establish early on.

Separate Personal and Business Finances

One of the most common mistakes founders make is mixing personal and business finances. Keeping them separate ensures clarity in bookkeeping and simplifies financial management. Opening a dedicated business bank account is essential to distinguish your startup’s income and expenses from personal funds. Similarly, using a business credit card for all startup-related expenses avoids confusion and creates a clear record of business spending.

Choose the Right Bookkeeping Method

Your bookkeeping method will define how and when you record transactions. There are two options to consider:

Cash Basis: You record income and expenses only when cash is received or paid. It’s simple and works well for small businesses with straightforward transactions.

Accrual Basis: Income and expenses are recorded when they’re earned or incurred, providing a more accurate picture of your financial health, especially if you have more complex operations.

Selecting the method that suits your business needs will make managing finances a lot easier.

Track Income and Expenses Regularly

Consistency is key when it comes to tracking income and expenses. Investing in bookkeeping software such as QuickBooks or Xero can automate the process, reduce errors, and save valuable time. Aim to update your records at least once a week to keep things on track.

Keep Detailed Records

Your startup’s financial records are essential for audits, tax filing, and providing transparency to investors. Save all receipts, invoices, and bank statements. Digital tools like Dext or Hubdoc make organizing and storing these documents much easier, giving you peace of mind and easy access when needed.

Understand Basic Financial Statements

Having a solid grasp of your financial statements is critical for understanding your startup’s performance. The income statement reveals profitability by showing revenue and expenses. The balance sheet provides a snapshot of your business’s financial health by highlighting assets, liabilities, and equity. Finally, the cash flow statement tracks the money moving in and out of your business, making sure you can cover expenses and maintain a healthy cash flow. If you want to learn more in-depth information on financial statements, check out our previous article, Understanding Financial Statements for Small Businesses.

By establishing these foundational bookkeeping practices, startups can create a financial system that supports growth, minimizes risks, and keeps the business on track.

Startup Accounting Tips: Streamline Your Processes

Running a startup is fast-paced and demanding, but these tips will help streamline your bookkeeping and financial management.

Set a Schedule

Consistency is your best friend when it comes to bookkeeping. Dedicate a specific time each week to update your records. This will keep your finances organized and prevent them from becoming overwhelming.

Leverage Technology

Use cloud-based tools to manage your finances in real-time and from anywhere. This means you can stay on top of your bookkeeping even while traveling or working remotely.

Hire Professional Help

If bookkeeping starts to feel overwhelming, consider hiring one of our Certified Public Accountants (CPA) or bookkeeper at KeyLin. They can save you time, ensure accuracy, and help you avoid costly mistakes.

Monitor Key Metrics

Stay informed about your business’s financial health by regularly reviewing profit margins, cash flow, and burn rate. These metrics will keep you on track and ensure you’re making the right decisions as you scale.

Common Bookkeeping Mistakes Startups Should Avoid

Despite good intentions, many startups fall into common bookkeeping traps that can hinder their success. Mixing personal and business finances is one of the most frequent errors, leading to confusion and making tax preparation unnecessarily complicated. Falling behind on data entry is another common mistake—keeping inconsistent records may result in missed deductions or penalties. Failing to reconcile accounts monthly can also be problematic, as regular reconciliation helps identify errors or fraudulent charges early. Overlooking small expenses might seem insignificant, but these costs can add up over time and impact your bottom line. Finally, neglecting to back up financial data is a risk you can’t afford to take; always maintain a secure backup to safeguard your critical records.

By following these tips and avoiding these pitfalls, startups can establish efficient bookkeeping practices that contribute to long-term financial stability.

Bookkeeping for Startups: Simplified with KeyLin

Startup bookkeeping doesn’t have to be overwhelming. You’ll gain clarity and confidence in your finances by setting up the right processes and systems. And if the numbers start to feel like too much? KeyLin is here to help.

From setting up your bookkeeping systems to providing expert startup accounting tips, our team specializes in simplifying financial management for startups. Schedule a free consultation today and let us help you build a solid financial foundation for your startup’s future success.