Top 12 Frequently Asked KeyLin Questions

The end of the year is coming, so we wanted to do a roundup of the most common questions we were asked in 2022. Whether you have questions about taxes, business expenses, income, or something else, we have the answers.

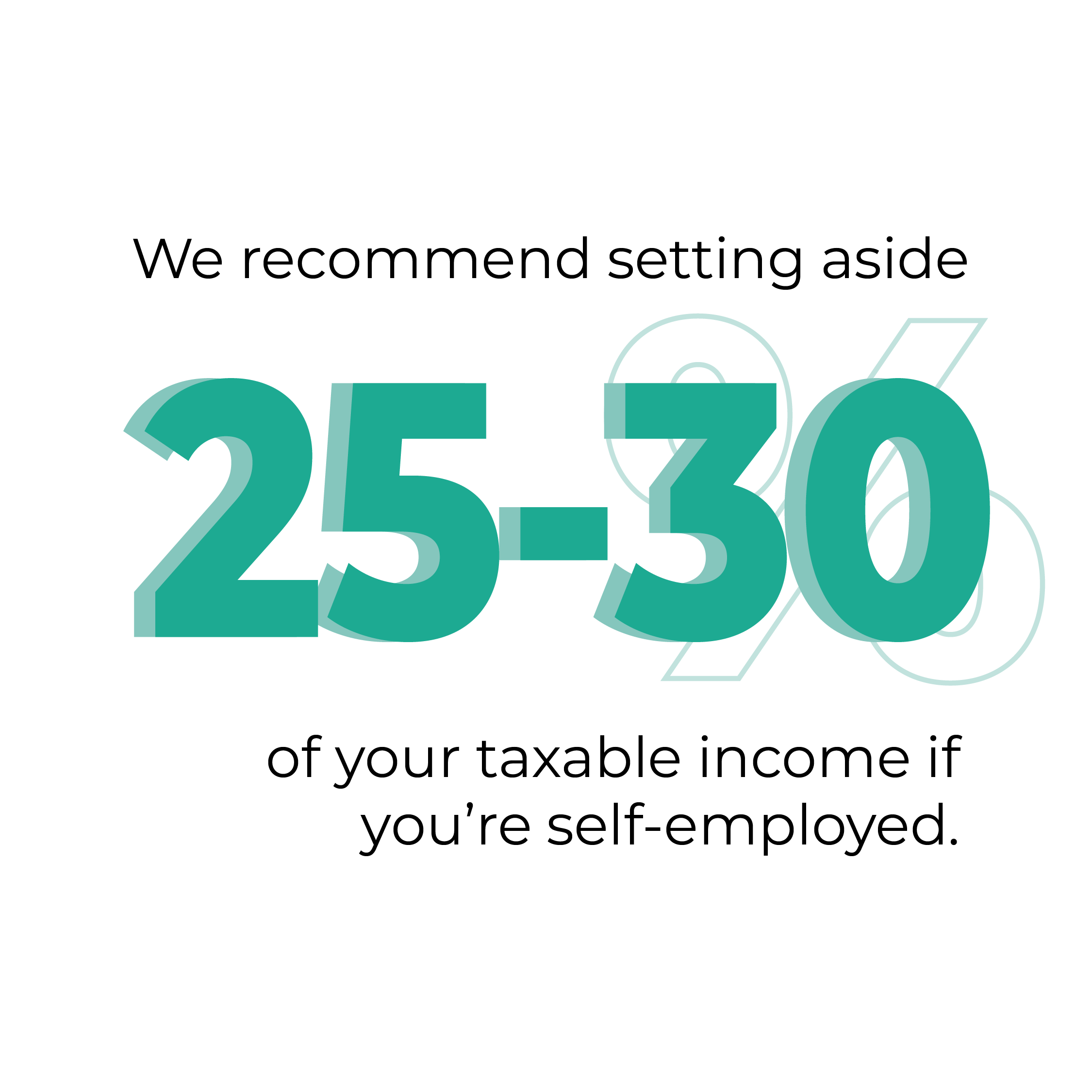

1. How much should I set aside for taxes if I'm self-employed? What is the self-employment tax rate?

The federal tax rate for self employment taxes is 15.3%, which covers both Social Security and Medicare. However, we recommend setting aside 25-30% of your taxable income if you’re self-employed. This will help pay quarterly taxes and any remaining taxes for your annual taxes.

We suggest saving a little more than what you expect to pay in taxes if you’re able, just in case. Even if you don’t use the extra savings for your taxes this year, it can help you stay ahead of business expenses or future taxes.

If you are a self employed, you may also be able to claim some deductions, so your taxable income will likely be lower than your total income for the year.

2. What is considered self-employment income?

Another similar question we’ve received is “Who is self-employed?” To answer both of these questions together, self-employment income is income received when providing services outside an employer-employee relationship. That means that people are considered self-employed if they “work for themselves,” such as by acting as gig workers, independent contractors, or sole proprietors.

Individuals who are self-employed and filing taxes must follow guidelines provided by the IRS, including after earning more than $400 in self-employment income. If you make less than $400 in self-employment income, you may still be obligated to file taxes, depending on other criteria.

3. Are retirement contributions tax deductible?

Contributions to retirement accounts may or may not be deductible, depending on the type of account you have. Deductions for retirement contributions depend on contribution amounts, income, contributions by employers, and potentially contributions made by spouses.

Most frequently, individuals who are self-employed may deduct retirement contributions made to Traditional IRAs or 401(k)s, but contributions to Roth IRAs are not deductible. Even still, the amount you can deduct for contributions to a Traditional IRA depends on your income and other retirement contributions.

If you’re a W2 employee and make contributions through your employer, that will be noted on your W2 form. If you’re self-employed and file on a Schedule C, your deduction may appear as an adjustment to your income.

4. What does it mean to itemize deductions? Why can’t I itemize my deductions?

Itemizing deductions is the process of claiming specific, qualified deductions on taxes based on expenses paid throughout the year, which can reduce one’s total taxable income. Examples of itemized deductions include, but are not limited to, interest on mortgages or investments, medical expenses, and charitable contributions. In contrast, the standardized deduction is one fixed amount, based on filing status.

However, certain factors can also require or prevent individuals from claiming itemized deductions. For example, using a 1040-EZ form prevents itemizing deductions, while individuals filing as married filing separately must use the same deductions (e.g., if one partner itemizes their deductions, both must).

Whether or not an individual or married couple should consider itemizing their deductions depends on their expected deductions. As a rule of thumb, if your itemized deductions will exceed the standard deduction, itemizing is a strong option.

5. Do I need to pay sales tax?

Yes. Most retail sales on goods — and even some services — in Minnesota are taxable. There are both state sales tax, which is 6.75% in Minnesota, and local sales taxes, which vary depending on your location. As a consumer, you’ll be responsible for paying sales tax at the time of purchase.

Keep in mind that if you’re selling goods or services that are subject to sales tax, you have a responsibility to collect it and pay it into the state. How you collect sales tax is up to you: you can add a separate line item onto receipts for sales tax, or add it into the total cost of the goods and note that the price is inclusive of tax. The payment schedule is available from your state, and will vary based on your tax liability. Either way, when you file your taxes, you cannot count sales tax on your receipts and income.

6. What other taxes should I worry about if I'm self-employed?

Many people pay self-employment taxes quarterly, also known as “estimated taxes.” This covers the federal self-employment tax, and allows the individual to better stay on top of their tax bill and the IRS to better understand the individual’s tax status.

If you’re filing taxes as self-employed, there’s a good chance you’ll need to pay estimated taxes. Estimated taxes split the total expected tax bill for the year into quarterly payments, which are paid in April, June, September, and January.

7. Why should I pay quarterly taxes? Can I pay my estimated taxes all at once?

Quarterly taxes do help the IRS better understand your tax status, but they also help you as an individual or small business owner. When you pay quarterly taxes, you distribute your tax bill throughout the year, so you can pay smaller amounts over time, rather than one lump sum.

If you would rather pay your estimated taxes all at once, you can, but you need to pay them all at the beginning of the year, at the first quarterly tax deadline. This deadline aligns with the traditional tax filing date. If you wait until the end of the year, you’ll be assessed a penalty, which will increase your total tax bill. While you can make one large payment, we recommend paying quarterly taxes on the schedule outlined by the IRS to help manage your expenses and make your returns go more smoothly.

If you underpay on your estimated tax, you will still owe the difference when you file. There is also a penalty for not paying quarterly taxes on time. If you are late in payment of your estimated taxes, you will owe an additional late fee, which varies based on interest rates, amount due, and the total time elapsed between the due date and your payment.

8. Do I need to file quarterly taxes? When do I need to pay quarterly taxes?

Quarterly taxes are paid by individuals who do not have taxes withheld from their earnings, like an employer may do. These individuals are typically self-employed, and can include sole proprietors, partners, and S corporation shareholders, though there are some exceptions. If you expect to owe more than $1000 in taxes when you file, you are likely expected to pay estimated, or quarterly, taxes.

Quarterly taxes are due every three months throughout the year: April 15, June 15, and September 15 of the tax year, and then January 15 of the following year, when you will be filing. Notably, these dates may shift slightly year to year, based on federal holidays and weekends. Regardless, be prepared to pay online or mail your payment in enough time for it to be received by the deadline in order to avoid penalty fees.

9. What do you need to start a business?

There are countless potential steps in starting a business, and the exact steps you take will depend on your needs, experience, and expectations. Generally, here are some of the steps we recommend everyone starting a small business take:

Write a business plan, establish funding methods, and understand your finances. These foundational steps will bring added clarity to your planning and execution moving forward.

Register your business. Depending on where you live, this process will vary, but you’ll need to:

Choose a business structure, like an LLC or S corporation, which will determine your tax structure and liability;

Choose a name and, if necessary, legally protect it, such as with a trademark;

Register your business with the government (federally, statewide, and locally, as needed), which will allow you to get a federal tax ID or tax-exempt number.

Apply for licenses and permits, so whatever you plan to sell or offer can be done legally. These will vary based on location and industry.

Open a bank account. When opening a business, you want your finances to be clear. Having separate bank accounts for your personal income and business income will make bookkeeping and accounting easier in the future.

10. Should I hire employees or contractors?

How much oversight are you hoping to have over this role? As a rule of thumb, the more oversight you provide, the more you should be considering employees. On the flip side, if a role is going to be more or less autonomous and in control of their own work schedule, outputs, etc., you will likely be OK going with a contractor.

Either way, hiring contractors is not a way to avoid hiring employees. Instead, look at independent contractors and employees as two roles that can support your business in unique and different ways.

Luckily, we just explained more about the difference between employees and contractors. For more details and information, read our article on the topic.

11. Who do I need to send a 1099 to at the end of the year? How do I send a 1099?

A 1099 is a tax form that documents payments made during the course of the year for business operations, such as payment made to a contractor for services rendered. If you pay an individual, LLC, or partnership more than $600 in a tax year, you need to file a 1099 with the IRS and send them a copy by January 31 of the following year.

When filing 1099 IRS forms, you can use electronic filing or paper filing. If you use print 1099s, you need IRS-issued forms, which are printed in triplicate. If you use electronic 1099s, use an authorized e-file provider to protect sensitive information.

Getting the necessary information for a 1099 at the end of the year can be challenging, so we recommend planning ahead. You’re required to get a W-9 from vendors and contractors when they start work. If you are self-employed and anticipate needing a 1099, you can proactively offer to fill out a W-9 to streamline your tax process, too. Remember — the tax you pay on 1099 income is the same as the self-employment rate of 15.3%.

12. Can W2 employees deduct home office spaces or any other expenses related to my employment? What are available tax deductions for W2 employees?

The short answer? No. Even if you work from home part of all of the time, your home office is not a deduction if you’re a W2 employee. Neither are other expenses you may incur through work, with very few exceptions. If you have multiple work-related expenses, consider talking to your employer about reimbursement or using company funds for them.

On the other hand, if you’re self-employed or a freelancer, you can deduct ordinary and necessary expenses. Depending on your scenario, portions of your home office space or expenses may be deductible, such as a proportional amount of your rent or mortgage for the square footage of an exclusive office space.

Collaborate with KeyLin on All Your Finance Questions

Accounting, bookkeeping, and tax preparation are complicated topics, and there are always questions about the details. At KeyLin, we’re always happy to answer any questions you have and share our knowledge with you, so you feel as equipped as possible when it comes to your finances. For more information, schedule an appointment with one of our experts today.