Understand Beneficial Ownership Information (BOI): What Your Business Needs to Know

Starting in 2024, a new regulation will affect businesses across the U.S.: Beneficial Ownership Information (BOI) reporting. Introduced by the Financial Crimes Enforcement Network (FinCEN), this mandate aims to increase transparency about the individuals who own and control businesses. Its purpose is to combat financial crimes such as money laundering and tax evasion by ensuring that the true owners of companies are identifiable.

In this article, we’ll guide you through the basics of BOI reporting, who needs to file, the steps involved, and important deadlines. While we’re happy to assist with this process, we aim to help you understand how to handle it independently.

What is Beneficial Ownership Information?

Beneficial Ownership Information (BOI) refers to critical information about the individuals who exercise significant control over a company or own a substantial portion of it. According to FinCEN, a “beneficial owner” is any individual who:

Owns 25% or more of a company’s equity

Exercises substantial control over the company, such as key decision-makers or executive officers

The goal of BOI reporting is to prevent anonymous entities from being used for illicit purposes. By identifying the true owners of businesses, this regulation seeks to create more transparency and reduce the risk of financial crimes.

Who Needs to File BOI?

BOI reporting applies to a wide range of U.S. companies, including:

Corporations

Limited Liability Companies (LLCs)

Other similar entities created by filing with a state or tribal authority

However, certain businesses are exempt from this requirement. Exemptions apply to:

Publicly traded companies

Large operating companies with more than 20 employees, $5 million in revenue, and a physical office in the U.S.

Regulated entities such as banks and insurance companies

If your business does not fall into one of these categories, you will likely need to file BOI reports to comply with the new regulations.

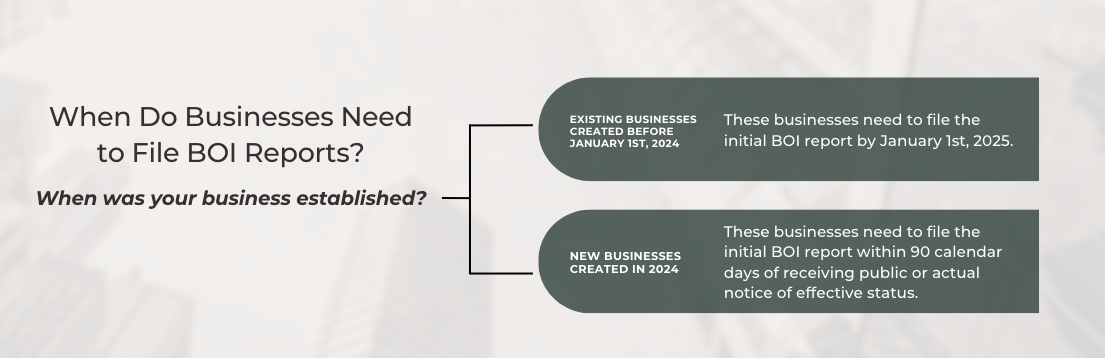

When Do Businesses Need to File?

The deadlines for BOI reporting depend on when your company was established:

Existing businesses created before January 1st, 2024, need to file the initial BOI report by January 1st, 2025.

New businesses created in 2024, need to file the initial BOI report within 90 calendar days of receiving public or actual notice of effective status.

Meeting these deadlines is crucial to avoid penalties. Failure to file on time or providing inaccurate information can lead to various consequences:

Financial Penalties: Businesses may incur fines of up to $500 per day for each unfiled or incorrect report.

Civil and Criminal Consequences: Consistent non-compliance or submitting false information may result in criminal penalties, including fines and, in more severe cases, potential legal actions impacting business operations.

Operational Restrictions: In cases of repeated or serious violations, authorities may impose restrictions on certain business activities or delay permit renewals, depending on jurisdictional regulations.

Steps to Complete BOI Reporting

The BOI filing process involves several steps to ensure accurate reporting. Here’s how to complete it:

Step 1: Gather Required Information

Before you start, make sure to have the following details for each beneficial owner and company applicant:

Full legal name

Date of birth

Residential address

Unique identification number (from a driver’s license, passport, or other government-issued ID)

A scanned copy of the identification document

Step 2: Access the Filing System

FinCEN will provide an electronic system for BOI submissions. Businesses must create an account, log in, and begin the process through this online platform. You can access the system by visiting FinCEN’s website.

Step 3: Complete the Form

On the BOI reporting form, you’ll need to enter all the previously gathered details for each beneficial owner. Be sure to double-check for accuracy—any discrepancies could result in penalties.

Step 4: Submit the Form

Once completed, submit the form electronically through the FinCEN portal. After submission, you’ll receive a confirmation of receipt, which you should keep for your records. Remember, if any changes occur in ownership or control, you must update the information accordingly.

How We Can Help

Filing Beneficial Ownership Information may feel overwhelming, especially for small businesses that are unfamiliar with the process. We’re here to help you out with the submission, but our main goal is to make sure you have the know-how and tools to tackle this on your own like a pro!

Our firm has extensive experience with BOI filings, and we can provide guidance every step of the way. If you prefer, we can take over the entire process, ensuring full compliance with FinCEN’s regulations. By working with us, you’ll avoid common mistakes that could result in penalties, saving you both time and stress.

Navigating BOI Reporting with KeyLin

Beneficial Ownership Information reporting is a crucial new requirement for businesses in the U.S. Understanding how to comply is key to avoiding penalties. By gathering the necessary information and following the steps outlined in this article, you’ll be prepared to manage the process confidently on your own.

Still, if you need additional support or prefer to have us handle the filing for you, we’re always here to help. Contact us today to ensure your business remains compliant with the latest BOI regulations and stays ahead of potential risks.