Understanding Financial Statements for Small Businesses

There are certain questions that most, if not all, small business owners can answer off the tops of their heads. Other questions, like what you spent in a specific time frame, may be harder to answer. That’s where the financial statement comes in.

Your financial statements are a treasure trove of information about your business, provided you know where to look. From balance sheets to profit and loss statements, there are several types of financial statements for small businesses you should understand be using regularly.

By leveraging these statements, you can better understand your business, leading to better decision-making over time.

Financial Statements for Small Business: The Ins and Outs

Before we get into understanding financial statements for small businesses, we want to touch on what financial statements are, and how they’re useful.

In essence, there are four primary financial statements for small businesses to pay attention to: the balance sheet, income statement, statement of cash flow, and statement of changes in equity. Each of these statements has its own unique purpose, but together, they form a fairly complete perspective of a company’s financial standing.

However, as you analyze these statements, it’s important to keep two things in mind.

First, these documents are a historical picture of your organization. They represent a moment, or moments, in time, rather than the entirety of the business’s financial performance.

Second, these documents are inward-facing, meaning they don’t cover the full picture. They are helpful for understanding things like income and expenses, but do not paint an all-encompassing picture of your business health.

Together, financial statements can help you paint a picture of financial performance, but it will still be up to you and your financial team to analyze the data and come up with solutions or strategies moving forward.

Balance Sheet

One of the most common financial statements is the balance sheet. Also known as the statement of net worth or financial position, this statement reports on a company’s assets, liabilities, and shareholder equity, if applicable. It provides a holistic perspective of the value of a company.

On your balance sheet, you will see three things: assets, liabilities, and equity. Assets are the things a company “owns,” like buildings and inventory. Liabilities are the things a company “owes,” like debts and expenses. Equity is what is “owed” to shareholders and other owners of the company. Together, these follow the formula of assets = liabilities + shareholder equity.

Notably, the balance sheet is just a snapshot of a moment in time, and does not provide insights into larger trends or themes to be analyzed, nor can it predict the future. However, it can provide its own insights, such as what parts of the business are succeeding and what parts could use additional attention.

Income Statement

Income statements, or profit and loss (P&L) statements, provide an overview of a company’s revenue, expenses, and profitability during a specific period, often a month or quarter. It demonstrates what revenue was generated, and what costs were required to reach that revenue. Typically, an income statement helps business owners understand their net income, which can inform future decision-making and strategies, like pricing strategies.

An income statement has a number of components to be mindful of:

Revenue | This is the amount that a business takes in during the reporting period.

Expenses | This is the amount that a business spends during the reporting period.

Cost of Goods Sold (COGS) | This is the cost of the production of goods and services of a company, including costs like labor and material, as well as indirect expenses, like distribution costs.

Gross Profit | This is the total profit after removing the costs associated with earnings. In other words, it is represented by “revenue - COGS = gross profit.”

Operating Income | This is the gross profit minus the operating expenses of the business.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) | This is another measure of profitability to net income.

Depreciation | This accounts for the lost value of assets over time, like a computer aging.

Income Before Taxes | As it sounds, this represents the income of the business before it pays taxes, and is represented by operating income - non-operating expenses.

Net Income | This is the total income after taxes, and is represented by “income - taxes.”

Earnings Per Share (EPS) | Like it sounds, this is the amount earned per share, and is calculated by dividing net income by outstanding shares.

Income statements can be used to better understand a moment in the business’s life, which can support business strategy, planning, partnerships, and taxes.

Statement of Cash Flow

Your statement of cash flow, also known as the cash flow statement, or CFS, demonstrates the cash position of a business, such as what money is coming in and from where, and what money is going out and to where. In other words, it shows how well a company makes cash to pay its bills.

Typically, cash flow is calculated using either the direct or indirect method. The direct method involves listing all the transactions during a reporting period. The indirect method, on the other hand, starts with net incomes and adjusts accordingly by adding or subtracting non-cash transactions.

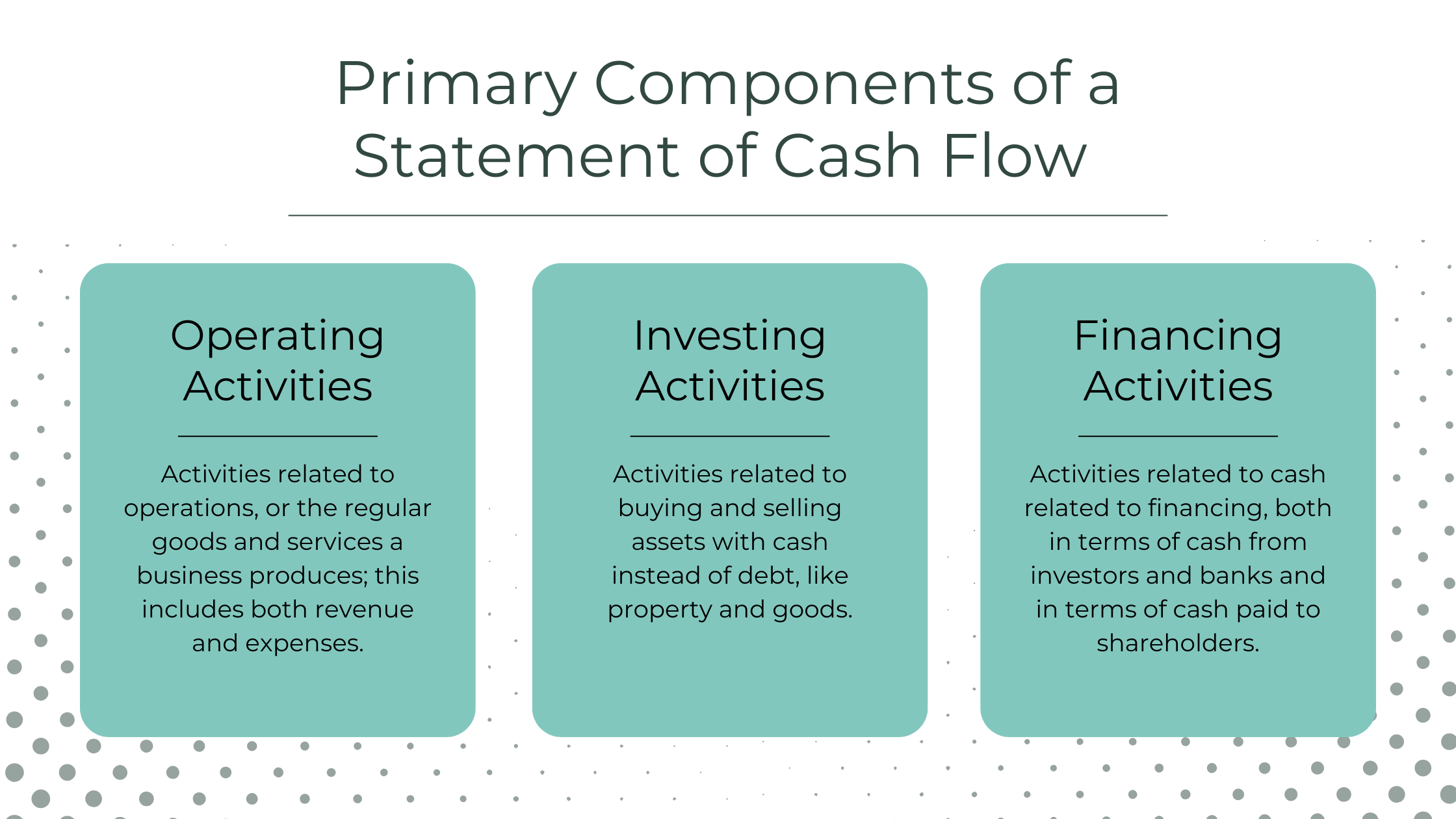

There are three primary components of a statement of cash flow: operating activities, investing activities, and financing activities.

As a business owner or leader, your statement of cash flow will show you what your cash flow looks like. This helps ensure that there is enough cash to fulfill short-term obligations, like making payments to staff or vendors. However, it can also enable long-term planning, increases in cash flow, and improved financial flexibility. By equipping you with the knowledge of what money is coming in and out, statements of cash flow can support the long-term financial health of your organization.

Statement of Changes in Equity

The statement of changes in equity (SOCE) is sometimes referred to as a statement of retained earnings, and it measures changes in the total assets and total liabilities to track total equity. In turn, this can help investors understand and fine-tune their investment strategies.

The statement of changes in equity also helps individuals, like the owner or leadership, to understand how much money the company is investing in its future growth versus spending.

This statement, which typically covers a year, is primarily used to understand owners’ equity during a period of time, and contains the following components:

Opening Balance | This is the end balance of the previous statement of changes in equity, which becomes the opening balance of the next statement.

Net Income | This is the total income earned by the company during its fiscal year, taken from the income statement.

Other Income | This is any income that may not be included in the income statement, like unrealized gains.

Issue of New Capital | When new shares are issued or there’s additional equity added, this gets added to the total equity listed.

Net Loss | This is the total loss incurred by the company during its fiscal year. Because it reduces the total capital of the company, it’s removed from the shareholder’s equity.

Other Loss | Like the “Other Income,” this accounts for other forms of losses that are not accounted for on the income statement, like unrealized losses.

Dividends | This represents the payments made to shareholders on their investments in the company. Because they are payments made to investors that reduce the total shareholder equity, they are deducted from the statement of changes in equity.

Withdrawal of Capital | This represents shares that have been redeemed or capital that has been withdrawn from the company, which reduces the total equity of the company and is marked as a deduction.

Part of running or overseeing a business is thinking of the future, and that means looking at investments. Whether that’s an investment in future growth or the investment of stakeholders, the statement of changes in equity can enable effective decision-making when it comes to future actions.

Simplify Financial Statements for Small Businesses: Partner with KeyLin

Financial statements for small businesses can feel complicated, especially if you don’t have a background in finance. From all the financial jargon to the influx of numbers, it’s easy to understand why keeping up with understanding financial statements isn’t a top priority, but it should be.

Your financial statements are one of the keys to running a successful small business. Together, they can provide you with an accurate assessment of your business’s financial health, support business decision-making, allow others (like investors or lenders) to better understand your business, and prepare you for tax season, just to name a few benefits.

No matter what financial statements you use to run your business, KeyLin is here to help simplify the process. Our expert team will help you with creating and interpreting your financial statements, which leads to better business decision-making and operational efficiency. Schedule an appointment today for your free first consultation and to get started understanding your financial statements.