Our Advice to 1099 Contractors: Tax Tips and Deductions to Know

Being self-employed has many benefits — you can make your own schedule, you’re your own boss, and you can take on the work that interests you most. But it can have downsides, too. Namely, tax season is more complicated as a 1099 contractor, because you’re responsible for tracking all your finances and paying your taxes out of your income, instead of having them withheld by an employer.

No matter what you do, here are some simple tips to help you optimize your tax season as a 1099 contractor.

What is a 1099 Contractor?

A 1099 is a tax form that covers payments made in the course of doing business. As a rule of thumb, 1099s are required if you’ve made payments over $600 to an individual, LLC, or partnership throughout the year.

A 1099 contractor, then, is a freelancer, independent contractor, or other self-employed person who completes work on behalf of the company without being an employee. (The most common type of 1099 for these people is 1099-NEC, which stands for “non-employee contractor.”) As a 1099 contractor, you have unique tax responsibilities to attend to, including filing your own taxes and tracking your own expenses and deductions.

In order to make life as a 1099 contractor easier, we’ve put together our top nine tax tips for you.

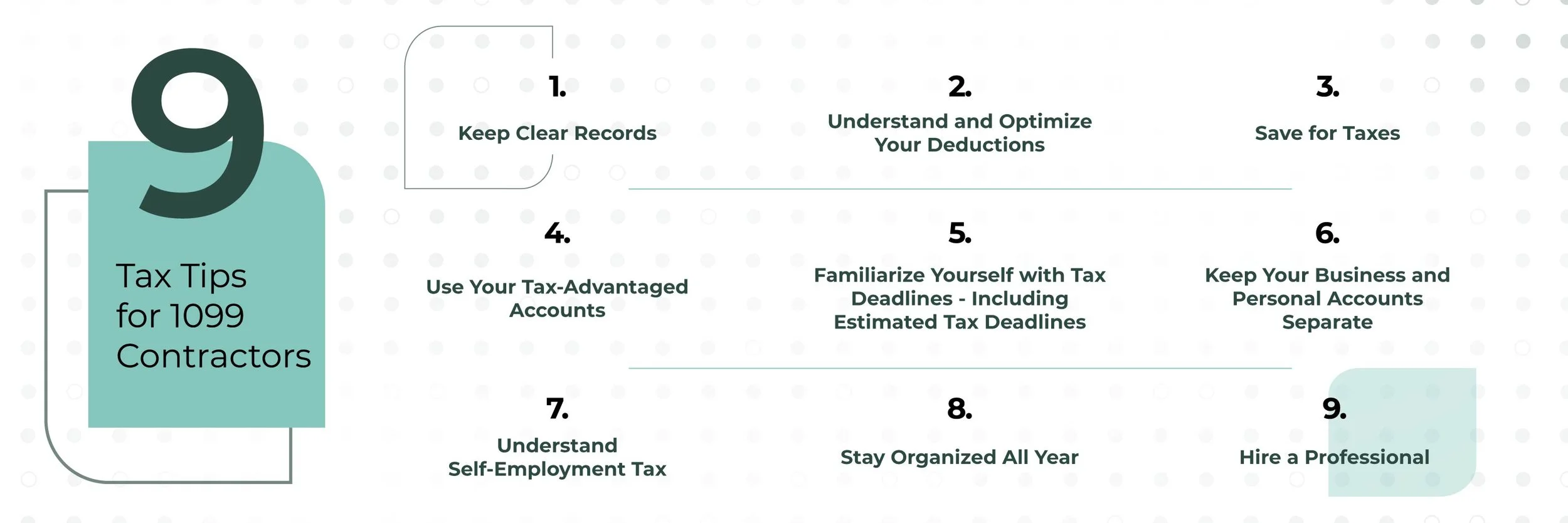

9 Tax Tips for 1099 Contractors

1. Keep Clear Records

Tracking your income, expenses, deductions, and estimated taxes is vital to your long-term success as a 1099 contractor. In the end, this will make filing your tax return go smoother, too, because you’ll already have documentation of all your finances. (And remember: you need documentation of all your expenses and deductions in order to claim them!)

We recommend tracking your information in a spreadsheet or using financial software like QuickBooks or Xero. You may also want to invest in a scanner so you can track digital and hard copies of all your receipts and important documents, just in case.

2. Understand and Optimize Your Deductions

You should familiarize yourself with all the deductions available to you, so you can optimize your return when the time comes. One of the benefits of being a 1099 contractor is that you can deduct things W-2 employees cannot, like your home office or mileage for commuting to see Clients. Below are some of the deductions you are likely able to take when you’re a 1099 contractor:

Mileage for work-related trips

Health insurance premiums

Home office

Work supplies

Work travel

Car expenses

Cell phone cost

Business insurance

Commissions or fees

Depreciation of assets

Remember, most deductions are dependent on the percentage of use that is for your business. (And many require your use to be predominantly for business.) For example, your cell phone deduction will depend on how much of your time on your phone is spent conducting business. Be sure to carefully track what portions of your use are for business versus personal to support claiming deductions later on.

3. Save for Taxes

As a 1099 contractor, you’re responsible for paying income tax and self-employment tax, which covers Medicare and Social Security contributions. You’ll also likely owe estimated taxes, also known as quarterly taxes, if your tax liability is $1000 or more. Saving for your taxes out of each check will make paying your estimated taxes easier, and it will help you in April when taxes are due and will help you avoid penalties.

4. Use Your Tax-Advantaged Accounts

Consider contributing to a solo 401(K) or a Simplified Employee Pension (SEP) IRA. As a 1099 contractor, you can save for retirement while reducing your taxable income. These kinds of accounts and contributions offer tax benefits while setting you up for success in the future.

5. Familiarize Yourself with Tax Deadlines — Including Estimated Tax Deadlines

Be aware of important tax deadlines, beyond just April 15. Depending on your unique situation, you’ll likely need to file estimated taxes. If you’re a 1099 contractor and expect to owe over $1000 in taxes, you’ll need to pay a portion of your expected tax liability in April, June, September, and January. Missing these deadlines can result in fines and interest penalties, so it’s important to stay on top of them.

6. Keep Your Business and Personal Accounts Separate

This is one of our top tips for 1099 contractors and entrepreneurs alike. By dividing your business and personal expenses, you’ll make tax season much easier on yourself.

We recommend having an entirely different bank account for business expenses, including a separate credit card as necessary.

We also recommend you never combine business and personal expenses, no matter how tempting it may be in the moment.

Finally, if you have to pay personal expenses with business funds, transfer business funds to a personal account and then remit payment from the personal account.

7. Understand Self-Employment Tax

As we mentioned above, you’re responsible for paying all your own taxes, instead of having them withheld from your paycheck. By understanding what you will owe and your taxable rate, you can better set aside funds to pay these taxes, whether you need to pay estimated taxes or you’re paying in April.

8. Stay Organized All Year

Don’t wait until tax season to start to gather your documents and receipts. By staying organized all year, you’ll be able to regularly review your finances and file necessary paperwork promptly. In turn, this will help keep you on top of your finances and make tax season go smoother.

9. Hire a Professional

Not sure if you’re filing your taxes appropriately or tracking all your necessary expenses? No matter what your concerns are, a financial professional can help. From accountants to bookkeepers to tax professionals, hiring a professional can save you time, money, and stress in the long term.

Plus, they can provide you with customized advice and guidance to ensure you’re doing everything you can to take advantage of tax savings opportunities and prepare for your future, whatever it may be.

Enjoy Being a 1099 Contractor with KeyLin

Like most things, life as a 1099 contractor is full of highs and lows. Don’t let tax season be a low. By taking advantage of these top nine tax tips for 1099 contractors, we hope you can streamline and simplify your tax season — and your recordkeeping all year long. Not sure where to start? Contact us today for your complimentary consultation, when our experts will be able to answer your unique questions and get you started on the right track.