Welcome to Tax Season 2023!

Tax season is here! We know not everyone gets as excited about tax season as we do, so we try to streamline what we can. From our three-step tax process to our communications, we want to make tax season the best it can be. In order to do that, we wanted to share a few updates from our team for current Clients.

A Reminder on Pricing

As a current Client, you should have received an electronic engagement letter via email with an estimate of this year’s pricing. As in prior years, this is an estimate and will be finalized when we prepare your returns.

Tax Season 2023 Process: SafeSend and Client Axcess

This year we are combining the organizer, tax return delivery, and signature process into one program called SafeSend. As a current Client, you will receive an e-mail later in the month to access the online organizer if you used the organizer program last year.

We will still utilize the Client Axcess portal for those of you who do not use organizers and just upload documents.

If you would like an online organizer, please let us know and we will send one out.

Our New Goal Date System

In the last several years, our office has been increasingly pressured for time during tax season. To adequately prepare tax returns for all Clients, we have found ourselves working 70, 80, and even 90 hours a week to get everything done (all at the expense of our personal health and family life).

Therefore, we are changing to a tax return "goal date" system this year.

This system will give you a date by which we would like you to mail, drop off, or upload your tax information to us. The "goal date" system provides you with a more definitive time to get your information together for us.

Within a few days after the "goal date," we will work on your return, determine if we need any further information, and notify you with accurate amounts of refunds or balances due, actions that we can suggest to reduce this year's tax bill, and advice for next year.

We believe this will allow us to prepare your return in a much more timely and productive manner. Your fee will still include preparation and email questions at no additional charge.

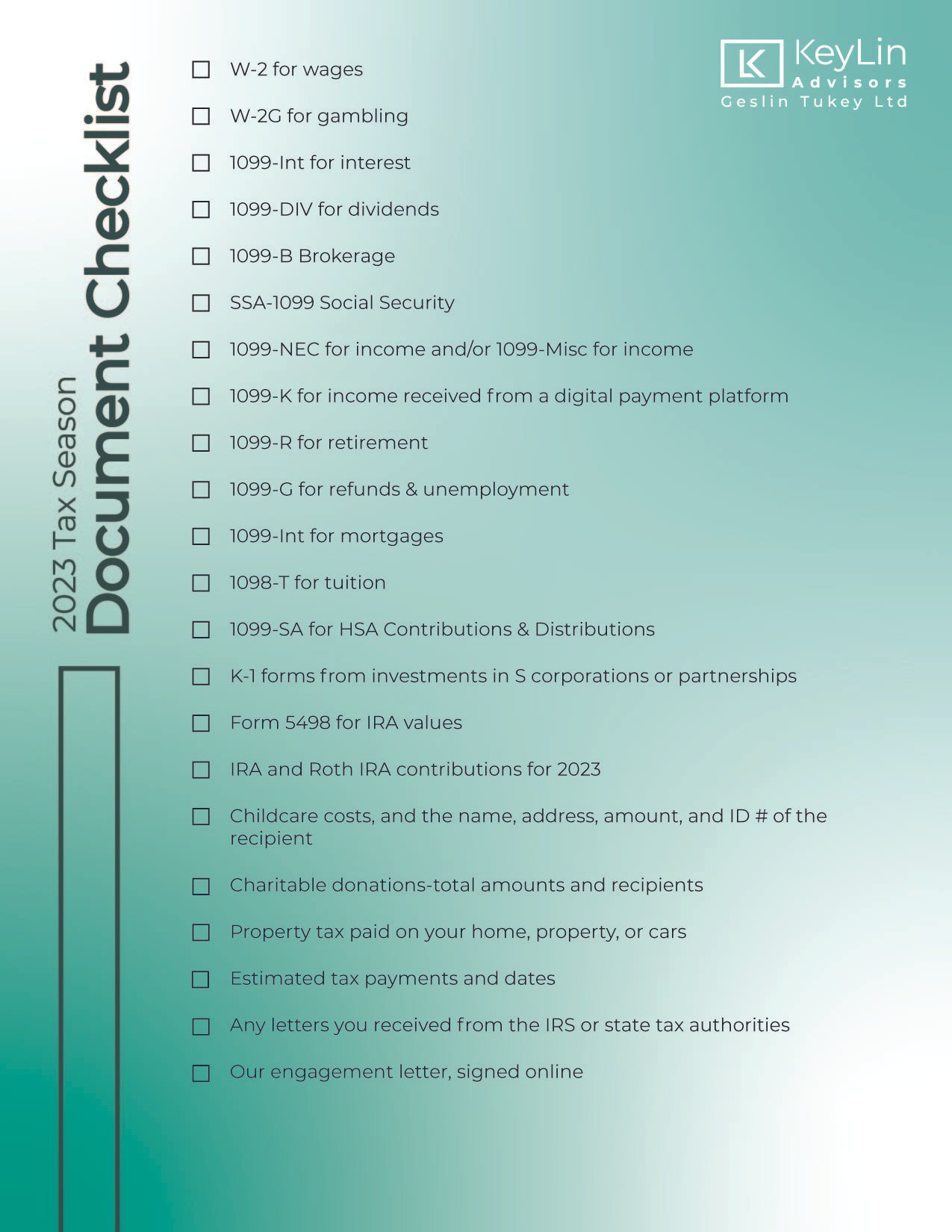

Checklist of Documents

As the tax reporting forms begin to arrive, we want to remind you which ones we need you to accumulate and send to us with your tax information. We still need the annual information forms that are sent to you for tax purposes. As a reminder, here is a simple checklist:

IRS scrutiny of foreign accounts means that you need to be absolutely clear about any non-US accounts or income so that we report it correctly.

New credits for home improvements went into effect this year and can provide you with tremendous tax benefits. If you installed a new furnace, A/C, boiler, heat pump, water heater, woodstove, windows, doors, insulation, solar or battery storage please be sure to provide us with a copy of the invoice.

Similarly, if you bought a new electric or hybrid car in 2023 please be sure to provide that invoice copy as well.

Finally, there are some exciting new tax planning tools for 529 plans (not just for education anymore!) that we can discuss if this is relevant to you.

Thank You and Talk Soon!

Every year we are reminded how much we value your business, and we want to, once again, say thank you.

We are looking forward to working with you all soon! Have a question? Always free to reach out or schedule an appointment to talk through your questions.